WHICH REPRESENTS YOU BEST?

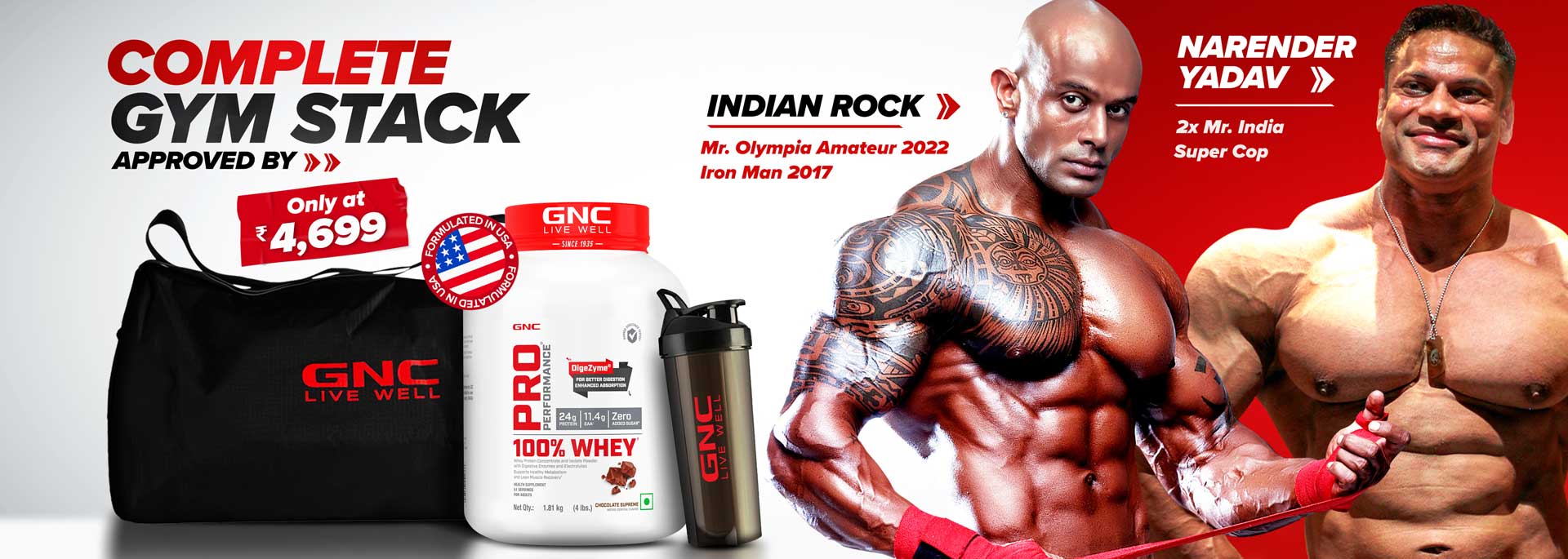

Fitness Stack

Ending in

Collection list

GNC is helping people improve their quality of life and stay fit and healthy

GNC is helping people improve their quality of life and stay fit and healthy

GNC is helping people improve their quality of life and stay fit and healthy

GNC is helping people improve their quality of life and stay fit and healthy

INDIA'S BEST MULTIVITAMINS

Discover the convenience of a superior multivitamin built into a complete program for your specific needs. We make it easy to be your best!

GNC Triple Strength Fish Oil

It provides two of the most important omega 3 fatty acids - DHA (Docosahexaenoic Acid) and EPA (Eicosapentaenoic Acid).

Shop NowGNC Mega Men One Daily

It contains 32 premium ingredients with essential vitamins, minerals,

and special nutrients to promote a healthy and active lifestyle.

GNC Womens One Daily Multivitamin

It is prepared using 32 premium quality ingredients with all the necessary vitamins, minerals, and other micronutrients, which are specially selected while keeping in mind the health needs of today’s woman.

Shop Now